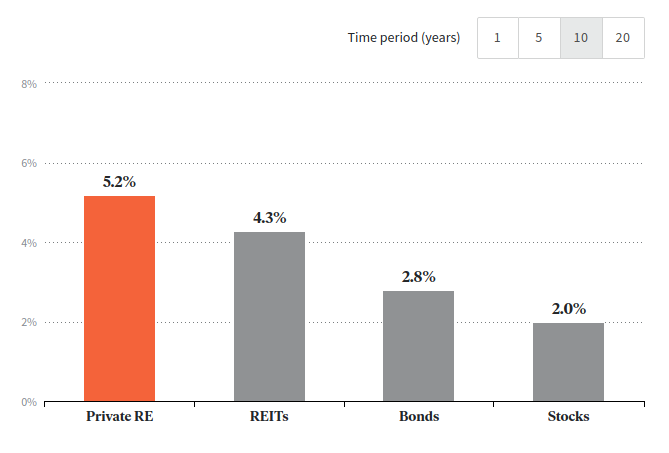

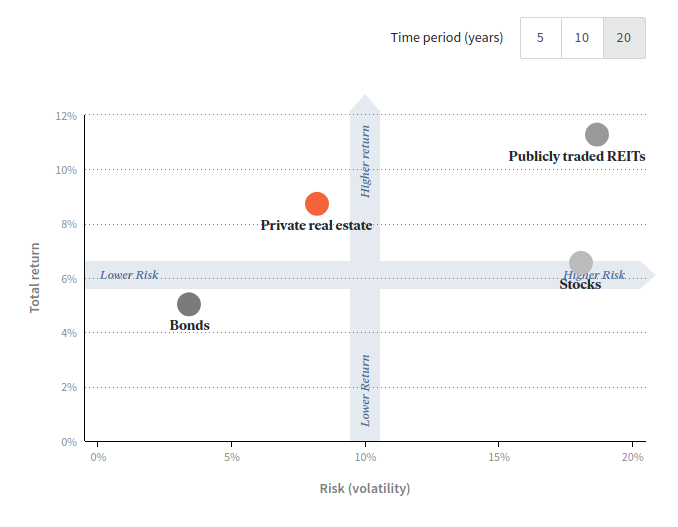

Represented by the Bloomberg Barclays U.S. Aggregate Bond Index, a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

Represented by the National Associate of Real Estate Investment Trusts (NAREIT) All REITs index, a market capitalization-weighted index that and includes all tax-qualified real estate investment trusts (REITs) that are listed on the New York Stock Exchange, the American Stock Exchange or the NASDAQ National Market List.

Represented by the National Council of Real Estate Investment Fiduciaries (NCREIF) National Property Index (NPI). This index goes back to 1978 and includes over 8,300 properties comprising over $658 billion in market value. Its objective is to provide a historical measurement of property-level returns to increase the understanding of, and lend credibility to, real estate as an institutional investment asset class.

Represented by the S&P 500, an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe (Investopedia).